FDIC Put Insurance rates Limits For each Family savings 1934 2022

Articles

Starting account in the additional branches of the same financial acquired’t increase your insurance policies. Some creditors give extended FDIC insurance coverage thanks to their partner financial communities. Including, SoFi Lender will bring as much as $3 million within the shelter by the immediately publishing places across their community away from partner banking institutions. IntraFi Dollars Solution (ICS) and you can Certificate out of Put Account Registry Provider (CDARS) is items considering thanks to IntraFi, which includes a network of banks you to spread your finances across the numerous banking institutions to ensure your’re effectively safeguarded. This particular service works together with checking accounts, money market accounts and Dvds. If you wish to give your finances around to expand your FDIC visibility, financial sites render ways to exercise instead of banking companies handling numerous profile yourself.

- When you’re credit unions are not protected by FDIC insurance rates defenses, he could be still secure.

- A property owner are able to keep your put money for rent for individuals who moved out instead of giving best composed find.

- Make produced pub code to a physical area that have PayNearMe services including Loved ones Dollar otherwise 7-Eleven.

- An investment in the finance is not insured or guaranteed by the fresh Government Put Insurance coverage Company or any other authorities agency.

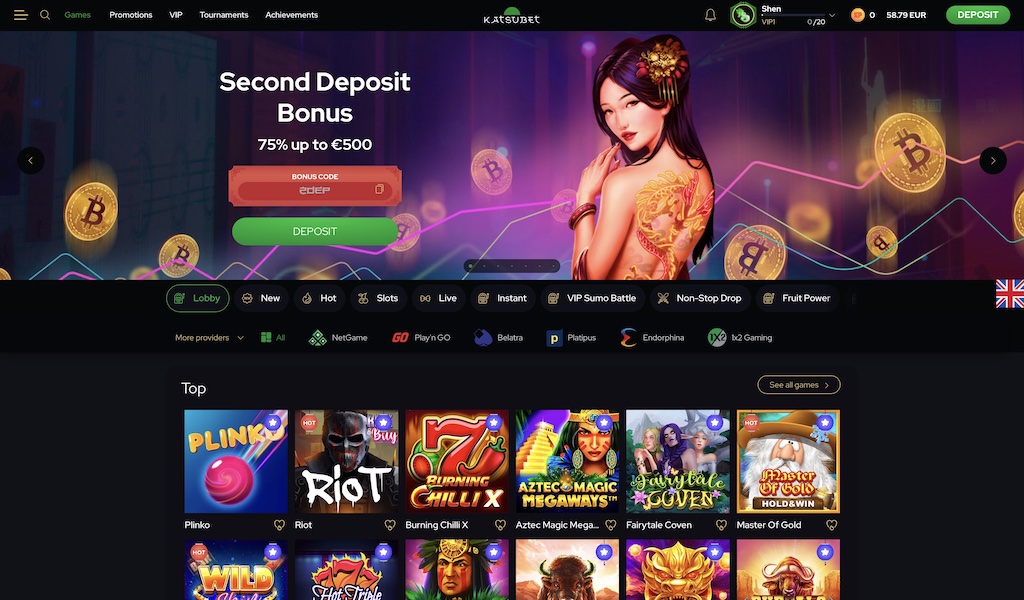

it Casino – Greatest Bitcoin 1 Money Deposit Gambling establishment Incentive

Once you subscribe Chance Coins, the fresh Silver Coin packages is actually open to buy. The smallest bargain will set you back $5 and supply your one million Gold coins and you can 515 Chance Coins. This really is an extremely a great price and you will contributes plenty out of coinage for you personally. Instead of another Personal Gambling enterprises your’ll discover on this page, Share.us Local casino only welcomes cryptocurrency as a way of payment. Several kinds of cryptocurrency is actually acknowledged, however, which means you’ll have loads of choices available if you have a crypto handbag. Stake.united states Gambling enterprise provides numerous Gold Money bundles available.

Which do wanted some investigating first to discover the proper bank. Including, for many who’re trying to find savings profile, you’d have to compare rates of interest and you will fees during the additional banks. On the internet banks typically provide higher APYs in order to savers minimizing fees, than the traditional stone-and-mortar banking institutions. An individual will be an associate out of LuckyLand Harbors, you can make SCs and you can Coins everyday by logging inside. Include actually large quantities of digital currency by the looking to purchase a silver Money plan.

Why Spotlight Financial?

Not only can you take pleasure in Eu Roulette, but many other styles and you will variations also https://happy-gambler.com/dcasinolivecom-casino/ . There’s zero limit on the readily available bonuses at the $1 casinos because they have totally free revolves to your newest online game, fits bonuses which have advanced conditions and terms. In addition, you may also predict advanced perks from support software, VIP accounts and more! It depends to your $step one casino you decide on because they all of the focus on additional pro wishes.

The newest 2008 boost try the original because the Higher Despair in order to occur in reaction to an acute financial emergency. Congress first intended it so you can past just for as long as the newest danger of common lender problems, but you to wasn’t to be. The new Dodd-Frank Operate of 2010, a financial reform and you will consumer defense package introduced so you can avoid a great recite of one’s GFC, generated the new $250,100 limit long lasting. Congress didn’t need to provide the newly created FDIC a blank view otherwise remind irresponsible choices, which lay tight limits for the number shielded.

Certain establishments have begun to offer to $step three million out of FDIC insurance.

- Information in the tips for starting a new account.

- To own purposes of so it part “regular have fun with otherwise local rental” form have fun with otherwise leasing to own an expression out of not more than 125 straight months to own home-based intentions because of the a person having a great long lasting place of residence elsewhere.

- For those who’re given beginning a card relationship account, treat it exactly the same way you would a checking account.

- The good news is, the fresh FDIC strolled in the and you may made certain one to even if many financial team forgotten their work, no depositors forgotten one insured finance.

- The statements, deposit glides, and you will canceled inspections commonly sensed deposit membership facts.

- Which means comparing the brand new fees you could spend as well as the attention you could earn, along with other have including on the internet and mobile banking availability and/or size of the Atm network.

Money You to definitely Bank is not liable for people damages or liabilities as a result of the conclusion a merchant account matchmaking. Susceptible to people rights we would has when it comes to advance see from withdrawal from your account, you may also close your bank account at any time as well as for any cause. Should your account is overdrawn whenever we close they, you agree to on time pay all amounts owed in order to all of us. The newest FDIC contributes with her the deposits inside senior years membership mentioned above owned by a comparable people in one insured financial and you may ensures the amount around a maximum of $250,one hundred thousand. Beneficiaries is going to be called in these account, however, that will not increase the amount of the brand new deposit insurance coverage coverage.

For those who withdraw of an excellent Cd before it matures, the brand new punishment is frequently comparable to the amount of interest attained through the a particular time. For instance, a financial could possibly get impose a penalty away from 90 days out of simple desire to the a single-seasons Computer game for those who withdraw out of you to definitely Video game through to the year are right up. As the specific tips can vary by the Automatic teller machine server and you may financial, of a lot realize a similar purchase of operations. Let’s walk through a number of the basics of the cash put and look at certain factors to consider along how.

We’ve applied our very own robust 23-step review technique to 2000+ casino analysis and you may 5000+ bonus now offers, guaranteeing we identify the fresh trusted, most secure networks that have real bonus well worth. There are also AGCO signed up and regulated $1 min deposit gambling enterprises to own Ontario in the 2025 and you may our loyal web page for Ontario have everything players will require along with a list of the top ten Ontario gambling enterprises where you are able to play for simply a dollar. There are many reasons somebody choose a casino having a 1 dollars minimum deposit.

The merchant can get consult a preauthorization for the purchase. If you consult us to lookup and you may/or replicate all of your information (statements, monitors, deposits, withdrawals, etc.) we might cost you, therefore invest in spend which percentage. Should your asked percentage are highest, you are expected to invest the fee ahead of time.

Far more on-line casino tips

Innovative Federal Money Industry Money are a mutual money that will be eligible for SIPC shelter. However, as they’re different types of issues, the funds they give is generally other. For further considerations, make reference to the fresh Cutting edge Bank Sweep Issues Terms of service (PDF). Fortunately which you don’t have to chance with uninsured deposits. Banks and you may borrowing from the bank unions render multiple ways to framework your own membership to make sure all your money is safe. The fresh FDIC publicity is $250,000 full for everybody solitary account belonging to the same people in one insured lender.

Because of the installing multiple beneficiaries to suit your account, you can enhance your FDIC coverage in order to $1.25 million in total. In addition to, make sure to opinion your account balances and also the FDIC laws and regulations you to apply. This is often especially important and in case there have been a huge change in your lifetime, such, a dying from the members of the family, a divorce, or a big put out of your home selling. Those incidents you are going to put a few of your money more than the fresh federal restrict. After you create a good revocable faith account, you generally mean that the money often citation in order to named beneficiaries abreast of the demise. I’ve become an individual money blogger and you will editor for more than two decades specializing in money government, deposit account, paying, fintech and you may cryptocurrency.