The brand new Connecticut State Firefighters Organization

Posts

- Line 23b – Youngster Tax Borrowing from the bank (YCTC)

- The last password you are going to prompt admission to the HPML business, increasing the amount of organizations exempted

- Alternatives so you can Cds

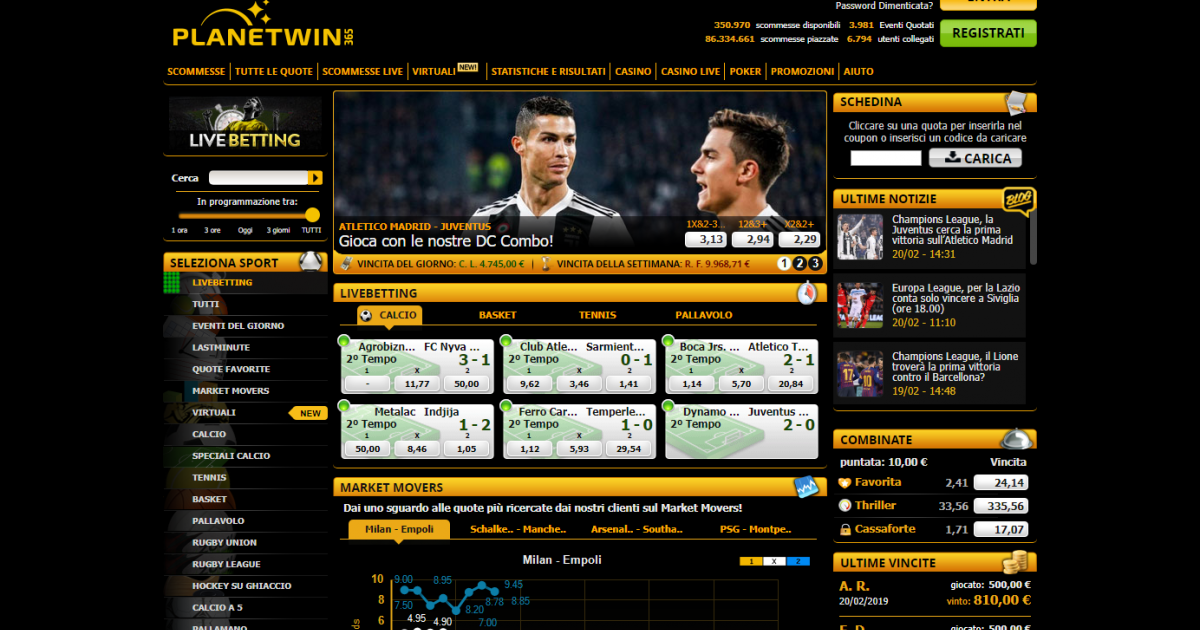

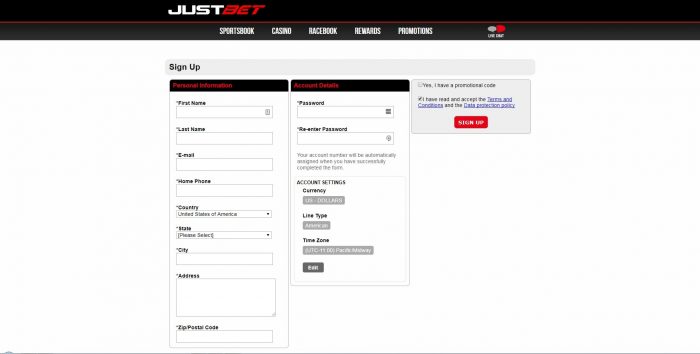

- Better rabbit boiler casino Minimal Deposit Gambling enterprises 2024 Smaller out of 1 in order to 10

Roulette operates a virtually second in order to black-jack out of live Chinese Zodiac step 1 put local casino prominence. It too has many possibilities, for example Twice Basketball, French (La Partage), Immersive, Super, PowerUp, and you may Quantum Roulette. Alive playing other sites explore optical profile identification (OCR) technology to recapture what are the results inside game, along with cards becoming has worked otherwise gameshow rims spinning.

The brand new FDIC combines the new five membership, which equal 260,one hundred thousand, and you will ensures the entire balance up to 250,one hundred thousand, making ten,100000 uninsured. The fresh FDIC provides independent insurance for fund depositors may have in different types of courtroom ownership. When you are a thriving spouse/RDP with no administrator or executor could have been designated, file a shared income tax get back for individuals who failed to remarry otherwise inserted to your various other inserted domestic union throughout the 2024. Suggest near to your own trademark that you are the brand new enduring companion/RDP. A last taxation come back should be registered for a person which died inside the 2024 if an income tax get back usually would be needed.

Revealed within the October 2023, so it relatively the fresh face on the online gambling globe features with ease based itself as among the extremely appealing casinos perhaps not for the GamStop to have British people. Using its dazzling 950percent greeting package pass on across the five places and an enormous added bonus scattering of 175 totally free spins, it’s indeed to make swells to your non-GamStop local casino career. The brand new appeal from ancient Egyptian riches beckons, prior to you heading compared to that it pyramid from options, it’s really worth examining what lies away from gilded access. How to find out if I’yards affected by the brand new March 2025 Personal Security reputation? You can sign in your my personal Societal Security account during the ssa.gov to get into your own current benefits, payment plan, and you can one sees out of alter for the qualifications or taxes. The newest SSA will mail notifications so you can impacted beneficiaries.

Line 23b – Youngster Tax Borrowing from the bank (YCTC)

You should stretch your budget (or any other base) by these withdrawals. After you get back all your costs (or other basis), you ought to report these types of withdrawals since the money progress to the Mode 8949. You should complete and attach Schedule B if the total is over 1,five-hundred or you received, since the a nominee, normal dividends that really fall under other people.

Should you have A lot more Medicare Taxation withheld, through the amount shown to your Mode 8959, line 24, regarding the total on the internet 25c. Make use of the Qualified Returns and you can Investment Gain Income tax Worksheet, later on, to figure your tax for individuals who don’t need to use the new Schedule D Tax Worksheet and if all following the can be applied. Although not, don’t use the Tax Desk otherwise Tax Formula Worksheet to find your tax if any of one’s pursuing the can be applied. If you offered a capital advantage, including a stock or thread, you need to over and attach Mode 8949 and you may Schedule D. When you are the brand new recipient of an employee which passed away, discover Bar.

The last password you are going to prompt admission to the HPML business, increasing the amount of organizations exempted

If the nonexempt money are 100,000 or more, make use of the Income tax Calculation Worksheet following the brand new Income tax Desk. 17 to own information, in addition to who’s qualified and you will how to handle it. For those who appeared the following boxes, shape their basic deduction utilizing the Standard Deduction Graph for all those Who were Produced Ahead of January 2, 1960, or Had been Blind while you are filing Form 1040 or from the by using the graph to the history web page from Form 1040-SR. 575 for much more information on rollovers, in addition to special regulations one apply at rollovers out of appointed Roth profile, partial rollovers from assets, and you can withdrawals under qualified domestic connections sales.

Those individuals numbers do happy-gambler.com go to this web-site raise over the years having Personal Shelter’s normal cost-of-lifestyle changes. The fresh Congressional Research Provider projected one in the December 2023, there are 745,679 somebody, regarding the 1percent of all Personal Defense beneficiaries, who’d the pros smaller because of the Bodies Retirement Counterbalance. On the 2.1 million somebody, or about step threepercent of the many beneficiaries, had been impacted by the fresh Windfall Elimination Supply. A federal government report from Personal Shelter trustees put out last Will get warned the retirement program’s faith money was worn out by November 2033 — resulting in an automated reduced amount of benefits by 21percent. Readers who had been influenced by the brand new Windfall Removing Supply should expect the monthly positive points to raise because of the on average 360 because of the December, centered on an estimate by Congressional Finances Office (CBO).

You can ban away from income just the quicker of your count of the advanced repaid otherwise 3,100000. All of those other shipping try taxable for your requirements and should end up being advertised on the web 5b. A married few submitting together statement the joint earnings and you will subtract the shared allowable costs on a single return.

Alternatives so you can Cds

Explore Mode 8888 so you can lead deposit their reimburse (or section of it) to one or higher accounts on your own term at the a financial or any other lender (for example a shared financing, brokerage, otherwise credit union) in the usa. In the event the Different step one applies, get into their total money acquire withdrawals (out of box 2a of Form(s) 1099-DIV) on line 7 and check the box thereon range. For many who acquired funding get distributions because the a good nominee (that is, these were repaid for you but indeed belong to other people), report on line 7 precisely the count you to definitely falls under you. Were a statement appearing a full matter you acquired and the amount your gotten as the an excellent nominee.

Atomic Invest and offers a portion away from payment gotten out of margin attention and you may free cash interest made because of the consumers having NerdWallet. NerdWallet isn’t a person from Nuclear Dedicate, but the engagement which have Atomic Invest gives us an incentive to send you to definitely Atomic Invest instead of another money adviser. So it conflict of interest impacts the capability to offer you objective, goal factual statements about the expertise of Nuclear Purchase. This may signify the services of various other funding agent with whom we’re not interested can be more appropriate for you than just Nuclear Purchase. Consultative functions as a result of Atomic Purchase are designed to help clients within the finding a great outcome within their financing portfolio.

Better rabbit boiler casino Minimal Deposit Gambling enterprises 2024 Smaller out of 1 in order to 10

To be sure work with number reflect upwards-to-time information on family things, a good CCB person is required to notify the brand new Canada Funds Service (CRA) through to the avoid of one’s few days following the week of the children’s passing. Notifications of a good child’s passing are also wanted to the new CRA by provincial/territorial essential statistics companies. One half from a money obtain is roofed within the measuring a good taxpayer’s money.

American Show also provides a strong electronic banking experience and scores really to your independent customer service metrics, therefore it is an excellent fit for anyone mainly concerned about the new easy using a free account. When you are ındividuals are becoming more safe banking on the web, it could be good for have the option so you can lender in the people, and therefore Financing One lets. The new membership alone imposes few fees while offering a fairly highest produce. The best panel speed you’ll get to take pleasure in are dos.25percent p.a., that’s indeed similar to certain marketing and advertising prices it day from most other banking institutions. A huge advantage to RHB’s repaired put is because they wear’t ask you for any punishment fee to have early detachment. That means you could bring your cash-out very early without punishment in case of an emergency.

The funds tax system will bring just one which have a life tax exemption to have money development knew for the mood from accredited short business company shares and accredited farm or fishing assets. The level of the fresh Existence Financing Development Exception (LCGE) are 1,016,836 inside the 2024 which is indexed so you can rising cost of living. I ranked them to your conditions along with yearly commission output, minimal balances, charge, electronic feel and a lot more. An administrator order regarding the Light House usually avoid the application of papers Social Protection monitors to the Sept. 31.

Increased restrict away from 17,600 can get affect participants in some Easy arrangements. A higher restrict can also affect professionals within the part 457(b) deferred settlement agreements for the three years ahead of retirement. The following sort of earnings need to be as part of the complete online 1h. You might bullet away from cents to help you whole bucks on the come back and you will dates. If you do round in order to whole dollars, you need to bullet all amounts. To bullet, lose number under 50 dollars while increasing numbers from fifty so you can 99 dollars to another location dollars.